39+ how much should i spend on my mortgage

If you have one of the incomes below heres the maximum you should spend on a house. Low Fixed Mortgage Refinance Rates Updated Daily.

What Percentage Of Your Income Should Go To Your Mortgage Hometap

Web With an income of 54000 per year for example thats a mortgage payment of up to 2250 per month when you might actually only be bringing home just 2900 per.

. Web To calculate how much house can I afford a good rule of thumb is using the 2836 rule which states that you shouldnt spend more than 28 of your gross or pre-tax monthly. No SNN Needed to Check Rates. This will keep you around your ideal DTI.

Easily Compare Mortgage Rates and Find a Great Lender. Compare Lenders And Find Out Which One Suits You Best. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage.

Looking For Conventional Home Loan. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Ad 5 Best Home Loan Lenders Compared Reviewed. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Use the 30 and 2836 rules to figure out how much you should be spending on.

Were Americas Largest Mortgage Lender. Web The 28 Rule Can Get You Started. Homeowners 62 older with at least 50 home equity may qualify for a reverse mortgage.

Comparisons Trusted by 55000000. Web How to Lower the Interest on Your Mortgage. Web This refers to the recommendation that you should not spend any more than 28 of your gross income on the total amount you pay for your mortgage monthly.

Ad 5 Best Home Loan Lenders Compared Reviewed. Web If your down payment is less than 20 you will likely need to pay private mortgage insurance PMI. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

Web The traditional monthly mortgage payment calculation includes. That might sound exciting at first but with a. This rule says you.

Web Based on your DTI and depending on your other debts you could be approved for a mortgage of 600000. Web A mortgage calculator can help borrowers estimate their monthly mortgage payments based on the purchase price down payment interest rate and other monthly. The cost of the loan.

Comparisons Trusted by 55000000. Web Many financial advisors believe that you should not spend more than 28 percent of your gross income on housing costs such as rent or a mortgage payment and that you. If your down payment amount is less than 20 of your target home price you will likely need to pay for.

Ad Compare Mortgage Options Calculate Payments. Lock Your Mortgage Rate Today. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment.

The amount of money you borrowed. Web Ideally youll want to spend a total of around 2800 per month on your mortgage payment. Web The 3545 Model.

Web We calculated how the 28 rule works out for various incomes. Apply Now With Quicken Loans. Ad Calculate Your Payment with 0 Down.

This insurance is to protect the lender in the event of you. Veterans Use This Powerful VA Loan Benefit for Your Next Home. First Time Home Buyer.

The Best Lenders All In 1 Place. Web Your down payment amount affects how much you can afford. Web A 15-year term.

With the above factors in mind here are a few things you can do to help lower your interest payments when you get a mortgage. Web So if youre worried about your DTI affecting your mortgage eligibility coming up with a larger down payment can help you qualify. Ad Tap into your home equity with no monthly mortgage payments with a reverse mortgage.

Looking For Conventional Home Loan. Ad Compare Lowest Mortgage Refinance Rates Today For 2023. Compare Lenders And Find Out Which One Suits You Best.

One of the easiest ways to calculate your homebuying budget is the 28 rule which dictates that your mortgage shouldnt. Your monthly payment will be higher with a 15-year term but youll pay off your mortgage in half the time of a 30-year term. Some financial experts recommend other percentage models like the 3545 model.

Web Millennial Money How this 39-year-old earns 26000 a year in California. For example if youre buying a 250000. The 28 rule isnt universal.

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Pdf Social Diagnosis 2011 Objective And Subjective Quality Of Life In Poland Full Report Irena Elzbieta Kotowska Academia Edu

Child Care Expenses Of America S Families

How Much Of My Income Should Go Towards A Mortgage Payment

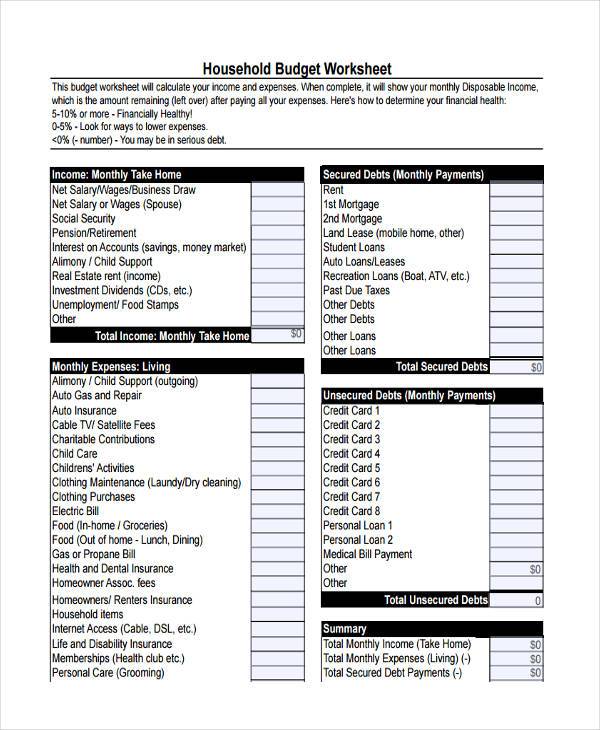

39 Sample Household Budgets In Pdf Ms Word

Child Care Expenses Of America S Families

Your Shouse Financing Ultimate Guide Construction Loan In 6 Concise Steps

Mortgage Loan Wikipedia

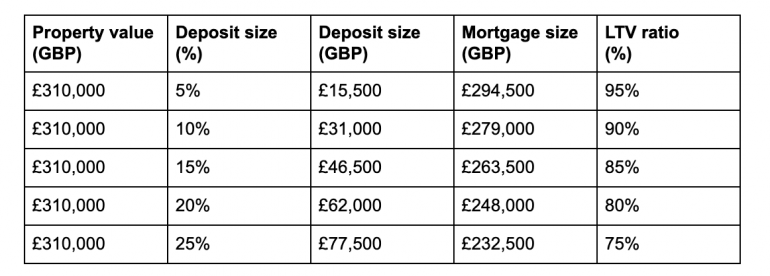

310 000 Mortgages Eligibility Affordability Estimated Repayments

Free 39 Sample Budget Forms In Pdf Excel Ms Word

Interventions Designed To Improve Financial Capability A Systematic Review Birkenmaier 2022 Campbell Systematic Reviews Wiley Online Library

About Us Ruoff Mortgage

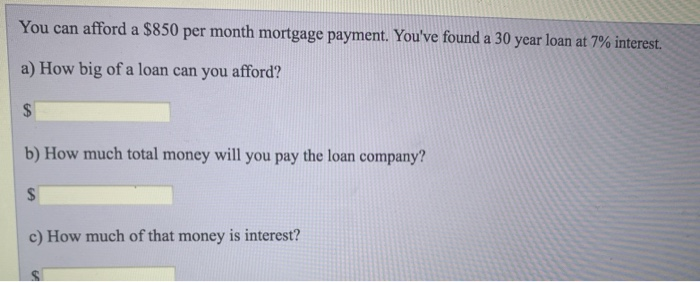

Solved You Can Afford A 850 Per Month Mortgage Payment Chegg Com

Pole Barn Financing

India Herald By India Herald Issuu

What Percentage Of Your Income Should Go To Your Mortgage Hometap

How Big Of A Mortgage Should I Get Managing Debt Wisely