29+ Back end debt to income ratio

This is calculated by taking the total monthly housing costs by income before tax. Ad Weve rated the best options for getting out of debt.

Asia Pacific Private Equity Report 2022 2022

Use this to figure your debt to income ratio.

. A standard maximum debt-to-income calculation for mortgages is 43. Find Mortgage Lenders Suitable for Your Budget. Compare Quotes See What You Could Save.

You would have 2900 in monthly debt payments. The DTI guidelines for FHA. For manually underwritten USDA.

A back end debt to income ratio greater than or equal to 40 is generally viewed as an indicator you are a high risk borrower. If your lenders DTI limit is 28 for front. This means you dont only include debt repayments for housing but also look at.

Debt to Income Ratio 5500 2440 443. Your debt-to-income ratio measures your monthly debt obligations in comparison to your monthly gross income or the amount of money you earn before taxes. See offers from verified Better Business Bureau accredited partners.

The back-end DTI ratio shows the income percentage covering all your monthly debts. 29 to 32 higher. Now assume you earn 120000 per year which would be 10000 in gross monthly income.

The debt-to-income DTI ratio is a personal finance measure that compares an individuals debt payment to his or her overall income. Back-end debt-to-income ratio. Total Monthly Obligations 2440.

Debt-To-Income Ratio - DTI. Your lender will likely use your open credit accounts showing on your credit. The formula is shown below.

This debt-to-income ratio calculator is designed to help you understand what you need to do in order to qualify and close on a mortgage loan. Proposed monthly property taxes insurance and HOA fees 475. Save 50 or more monthly.

Measuring your ability to manage debt helps lenders determine if. This percentage represents the highest DTI ratio permitted for qualified mortgages loans that meet. The back-end DTI includes all your minimum monthly debts.

Ad Get Your Best Interest Rate for Your Mortgage Loan. Your debt-to-income ratio is between 29 and 42 which means that your risk is considered average by most lenders. Back-end 29 to 42.

In this example if you apply for a mortgage with your spouse your front-end DTI ratio will be 2053 and your back-end DTI ratio will be 3417. Compare Quotes Now from Top Lenders. Back end the debt to income ratio on the back end includes all expenses including housing.

Today the debt ratio requirements for an FHA. Your debt-to-income ratio is an important figure that projects how easily youll be able to make your mortgage payments. It is calculated by adding up your total monthly bills such as your credit card debt payments.

The back-end ratio can be calculated by summing the borrowers total monthly debt expenses and dividing it by their monthly gross income. Divide 2900 by 10000. Calculate your debt-to-income ratio the percentage of your gross monthly income that goes toward paying your total monthly debts.

The monthly payments include student loans credit cards personal loans and.

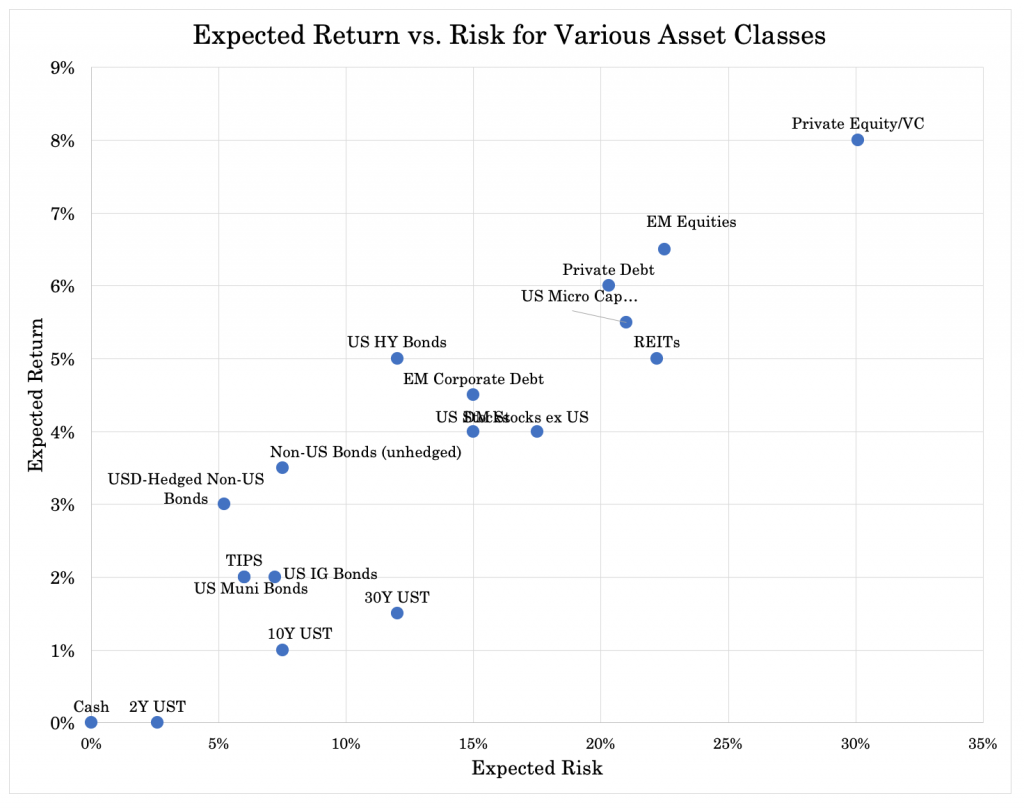

How To Improve Risk Adjusted Returns Daytrading Com

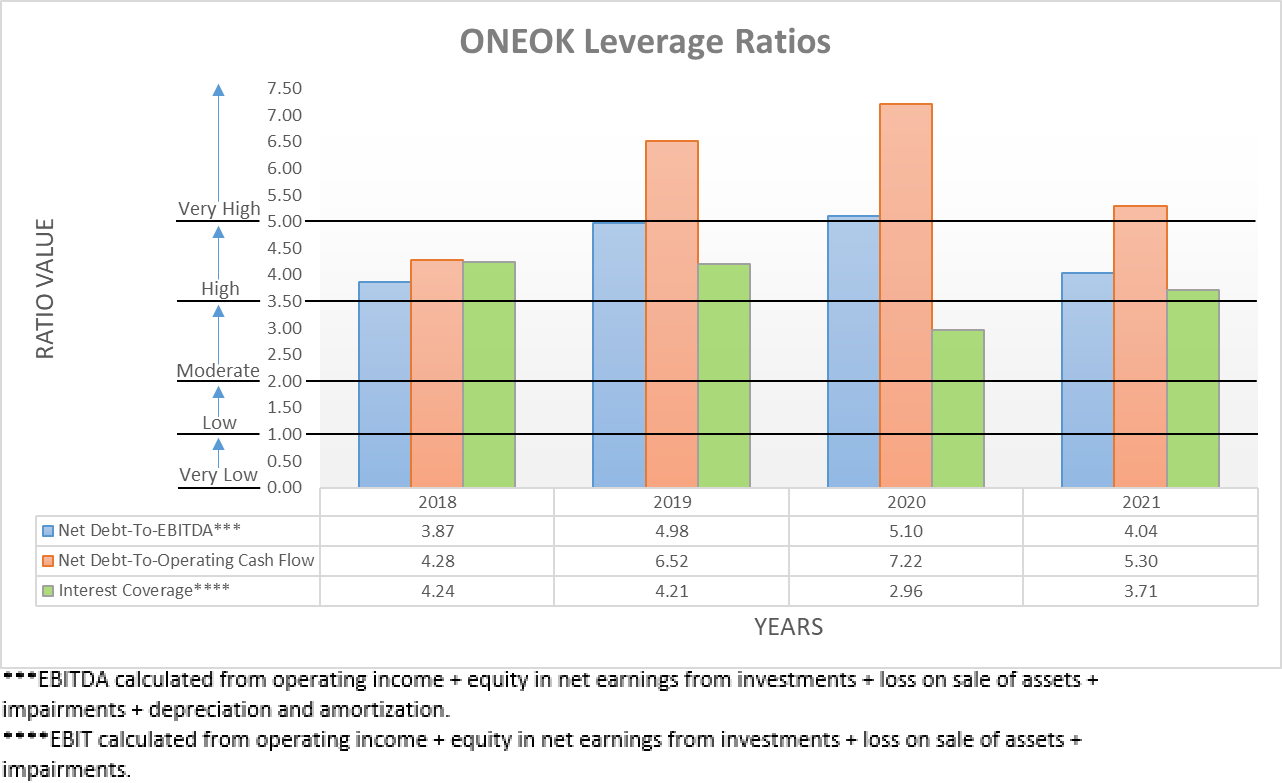

Oneok Strong Performance A New Era For Dividends Nyse Oke Seeking Alpha

Fha Debt To Income Calculator Debt To Income Ratio Real Estate Advice Fha Loans

Premium Vector Core Values Landing Page Template Tiny Businesspeople Characters Stand On Ladder Holding Huge Puzzle Piece With One Of Basic Social And Business Principles Mission Cartoon People Vector Illustration

Back End Debt To Income Ratio Debt To Income Ratio Debt Ratio Debt

Premium Photo Closeup Of Tax Form 1040 With A Pen And A Notebook On A Black Background

What Is A Personal Loan And How Does It Work In 2022 Personal Loans Financial Management Balance Transfer Credit Cards

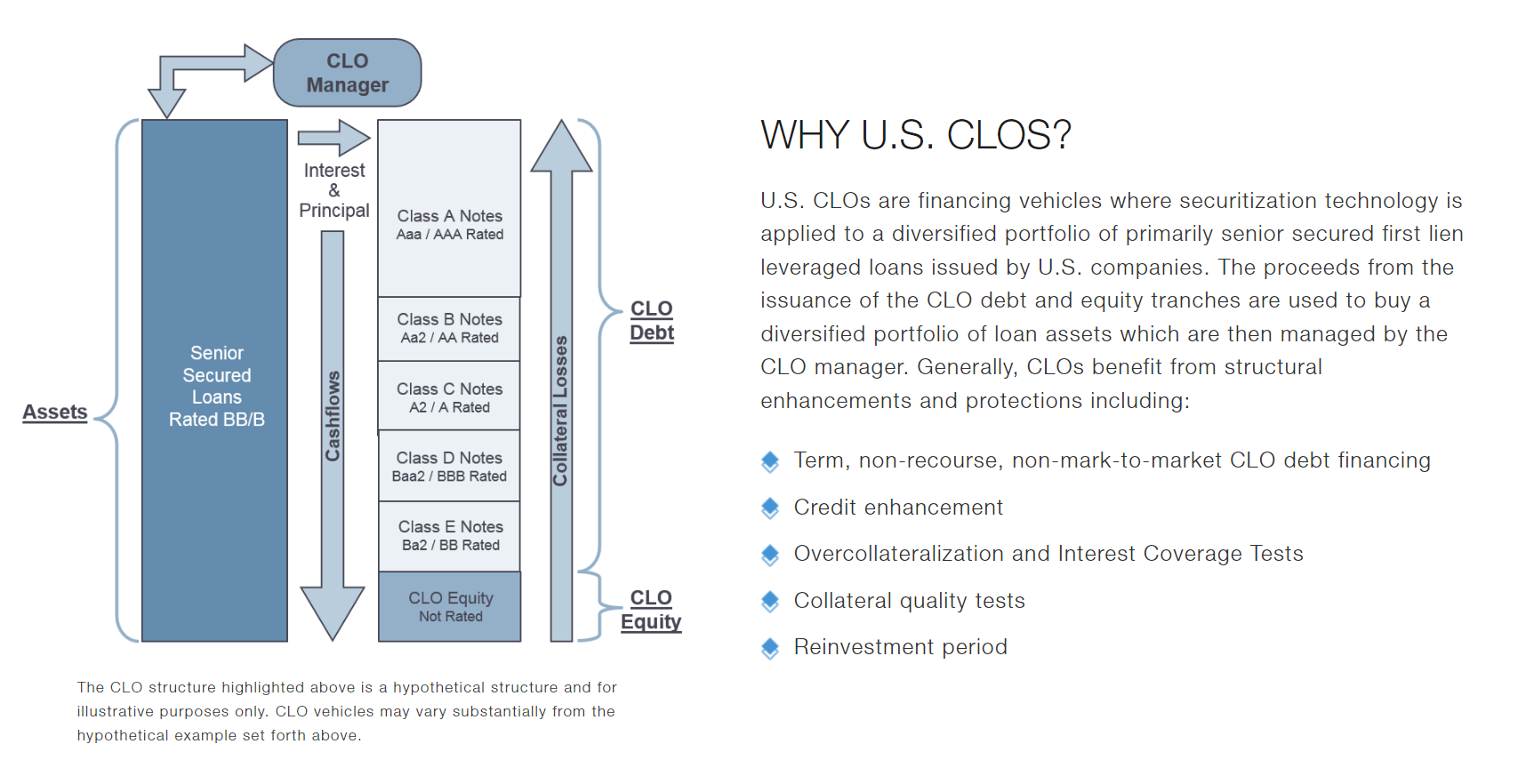

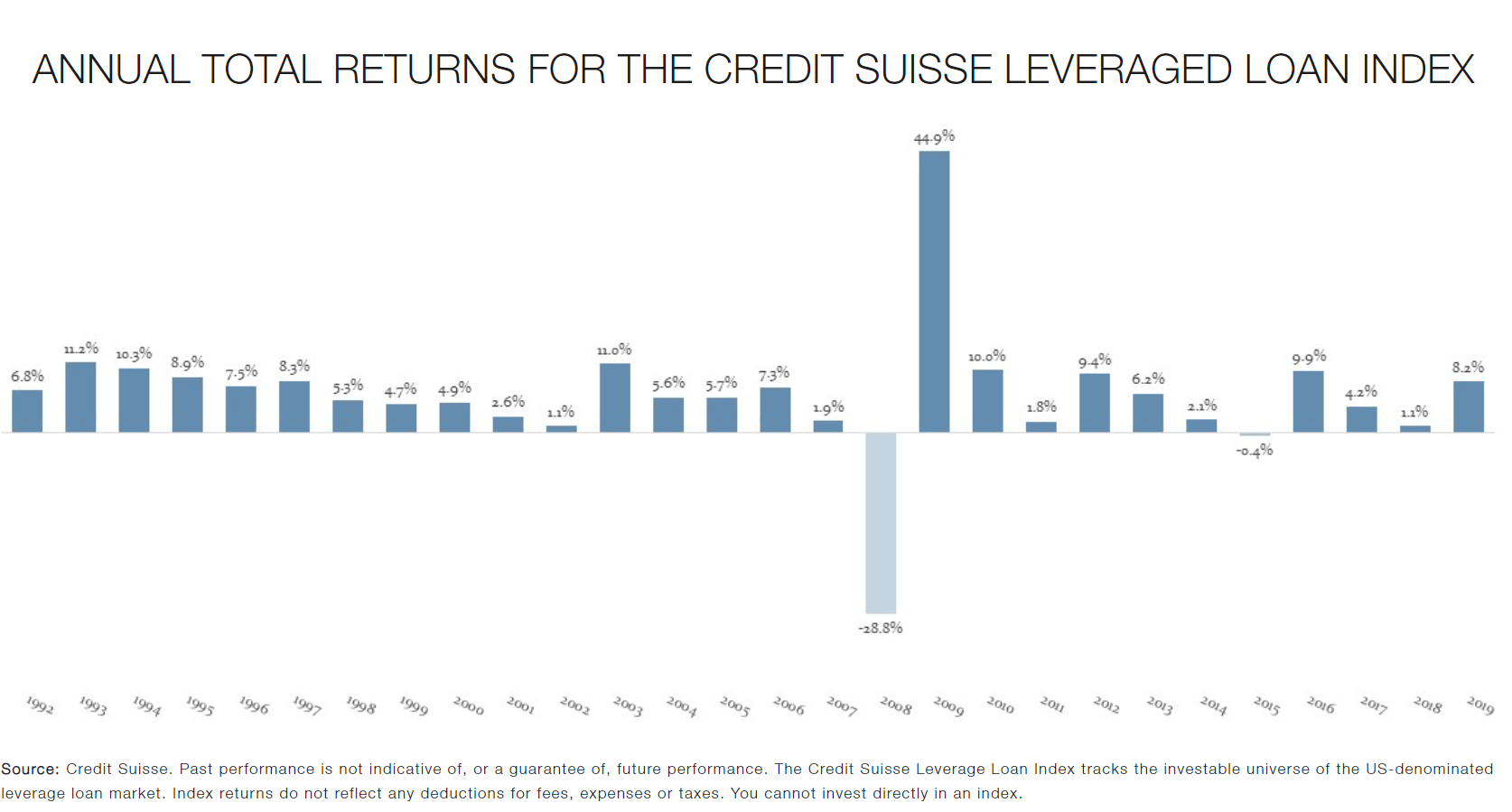

Oxford Lane Capital Stock Look Beyond The Yield Nasdaq Oxlc Seeking Alpha

Fha Debt To Income Calculator Debt To Income Ratio Real Estate Advice Fha Loans

Oneok Strong Performance A New Era For Dividends Nyse Oke Seeking Alpha

Mortgage Tips And Tricks Assumption Assuming A Mortgage Home Mortgage Mortgage Tips First Time Home Buyers

Where Are Stocks Heading Quora

Premium Vector Business Concept Teamwork Of People S Working Financial Business Calculator Flat Vector Cartoon Character Illustrations

2

Asia Pacific Private Equity Report 2022 2022

Oxford Lane Capital Stock Look Beyond The Yield Nasdaq Oxlc Seeking Alpha

Asia Pacific Private Equity Report 2022 2022